Disclaimer: The information provided in this article is for educational and informational purposes only and should not be considered financial advice. The author is not a financial advisor and the content of this article is not intended to be a substitute for professional financial advice. Always seek the advice of a qualified financial professional before making any financial decisions.

Navigating the world of investing can be intimidating, especially for beginners. However, with an integrated AI like ChatGPT, anyone can feel confident in making financial decisions through asking AI investing questions. That’s where SavvyTrader.ai comes in. Designed to assist you with various investing questions, this AI investing assistant utilizes ChatGPT technology for an active and engaging experience. This article will explore sample question categories and provide examples for each, helping you make the most of your experience.

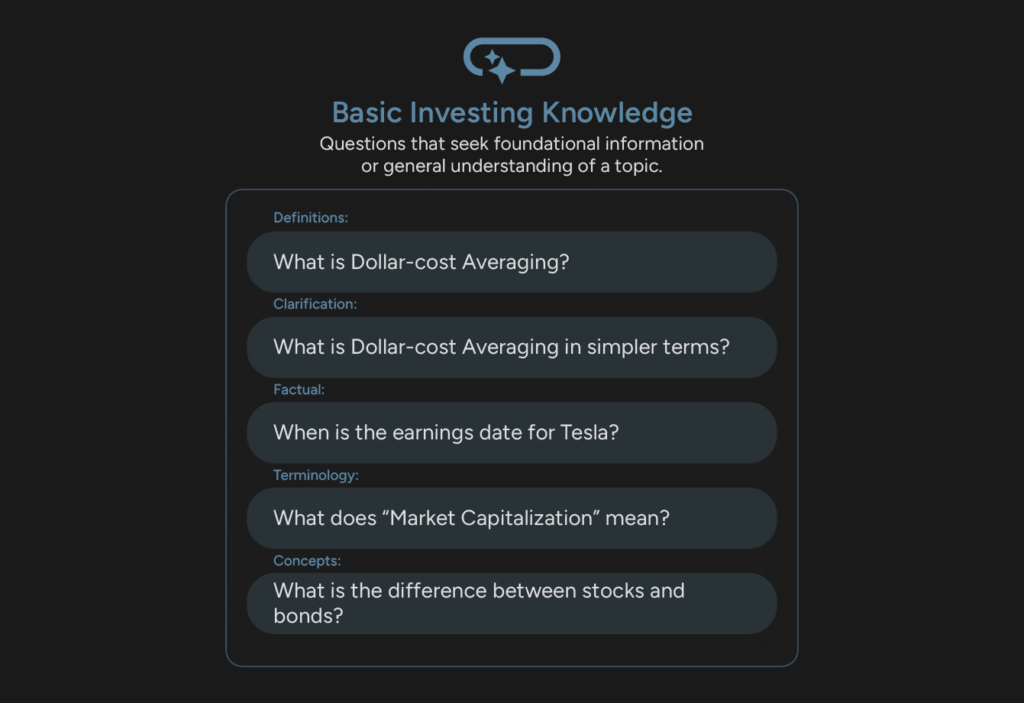

1. Basic Investing Knowledge

For those new to investing, understanding basic concepts and terminology is essential. SavvyTrader.ai can provide definitions, clarify complex terms, and answer factual questions about companies or events. For example, you might ask:

What is the difference between stocks and bonds?

Stocks and bonds are both investment options, but they differ in several ways. Stocks represent ownership in a company, and their value is determined by the company’s performance and the demand for its shares in the market. On the other hand, bonds represent a loan made by an investor to a company or government entity, and their value is determined by the interest rate and the creditworthiness of the issuer. In general, stocks are considered riskier but have the potential for higher returns, while bonds are considered less risky but have lower potential returns.

Savvy Trader AI

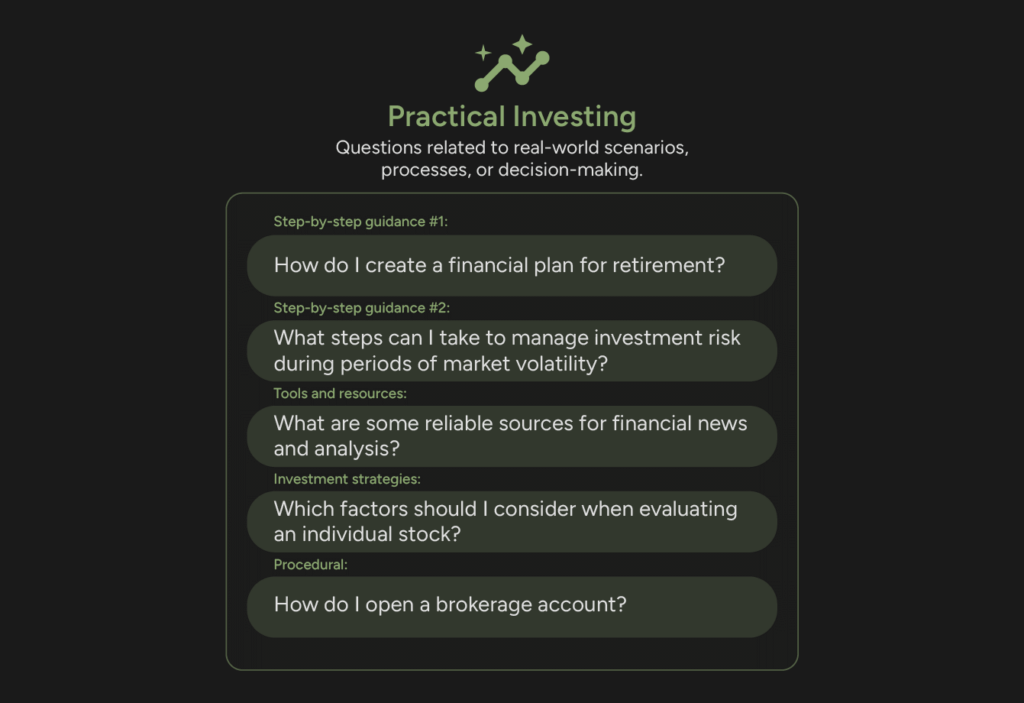

2. Practical Investing

SavvyTrader.ai can guide you through real-world investing scenarios and help you make informed decisions. You can get step-by-step instructions, information on tools and resources, or help evaluating investments. Here’s an example question:

Which factors should I consider when evaluating an individual stock?

Some factors to consider when evaluating an individual stock include the company’s financial health, management team, competitive landscape, industry trends, and valuation. It’s also important to consider any potential risks or uncertainties that could impact the stock’s performance. As always, do your own research and consult with a financial advisor before making any investment decisions.

Savvy Trader AI

3. Speculative Investing

SavvyTrader.ai can provide insights on market predictions, scenario analysis, potential risks, and more for those interested in exploring hypothetical situations or anticipating market trends. A sample question might be:

What could be the impact of increasing inflation on stock prices?

When inflation rises, it can lead to higher interest rates, which can negatively impact stock prices. This is because higher interest rates can increase borrowing costs for companies, which can reduce their profitability and ultimately lower their stock prices. Additionally, higher inflation can also lead to a decrease in consumer spending, which can hurt companies’ revenues and earnings. However, some companies may be able to pass on higher costs to consumers through price increases, which could help mitigate the negative impact of inflation on their stock prices. Overall, the impact of inflation on stock prices can vary depending on a variety of factors, including the severity of the inflation and the specific companies and industries involved.

Savvy Trader AI

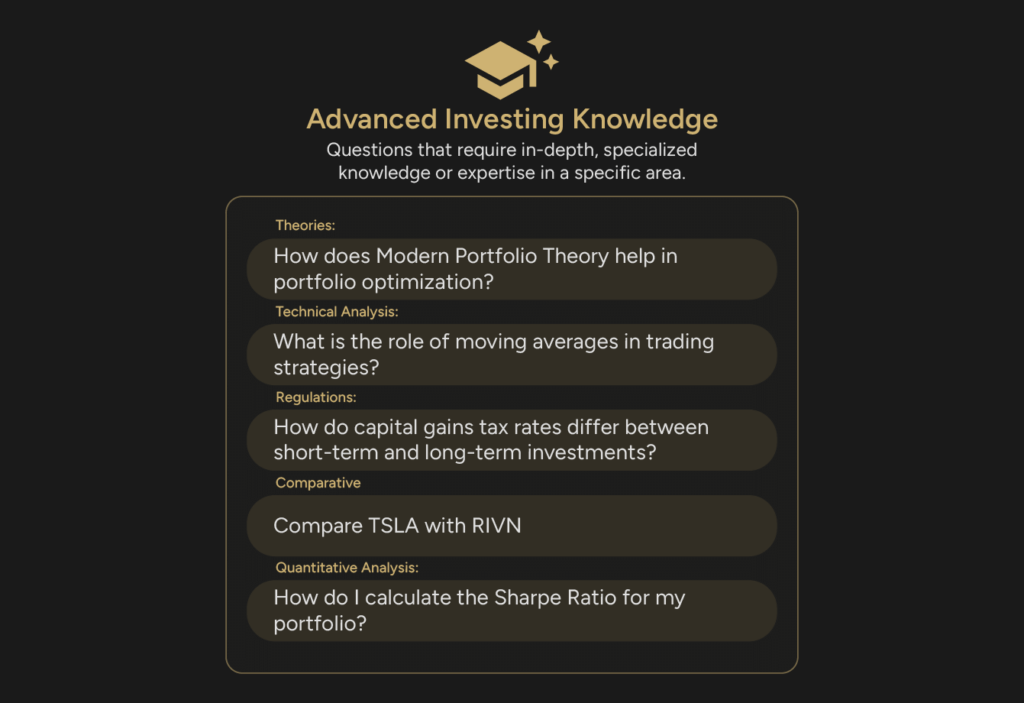

4. Advanced Investing Knowledge

If you’re looking for specialized knowledge or expertise in specific areas, SavvyTrader.ai can help. You can ask about investment theories, technical analysis, regulations, etc. For instance:

How does Modern Portfolio Theory help in portfolio optimization?

Modern Portfolio Theory (MPT) helps in portfolio optimization by providing a framework for constructing portfolios that balance risk and return. MPT suggests that investors can minimize risk by diversifying their portfolio across different asset classes and securities. By combining assets with low correlations, investors can create a portfolio that is less volatile than any individual security. MPT also suggests that investors should focus on the expected return of a portfolio rather than the return of individual securities. This approach helps investors to construct portfolios that are optimized for their risk tolerance and investment objectives. Overall, MPT is a valuable tool for investors looking to build diversified portfolios that balance risk and return.

Savvy Trader AI

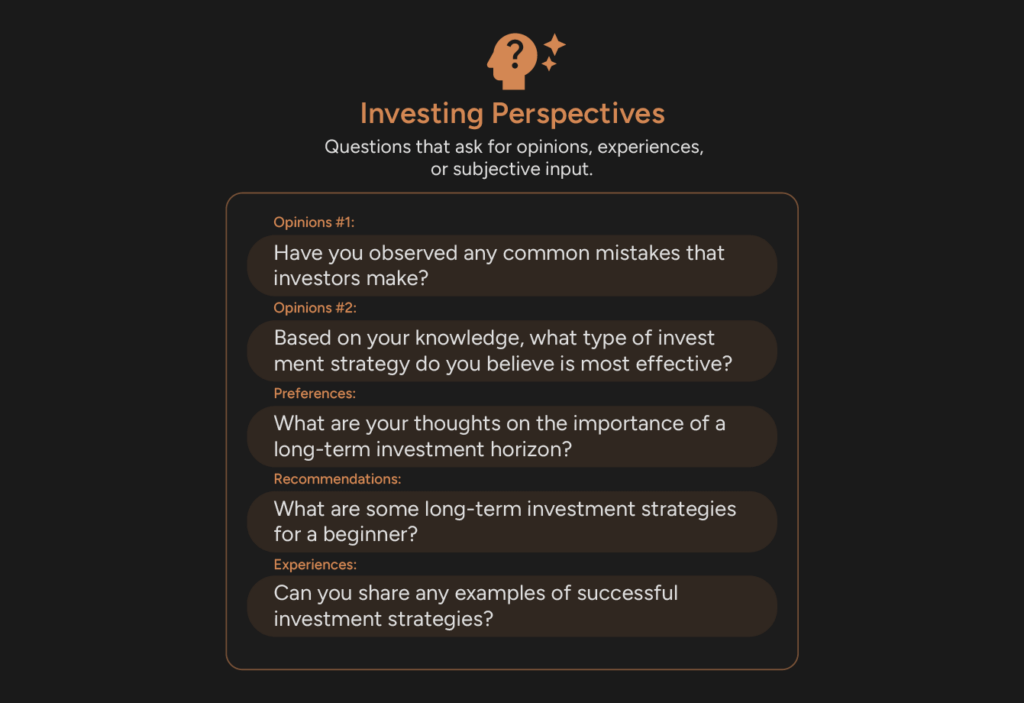

5. Investing Perspectives

SavvyTrader.ai can share opinions, recommendations, and experiences on various investment topics. For example:

What are some long-term investment strategies for a beginner?

As a AI language model, I can suggest some long-term investment strategies for beginners. One of the most important things to keep in mind is to diversify your portfolio. This means investing in a variety of assets, such as stocks, bonds, and real estate, to reduce risk. Another strategy is to invest in low-cost index funds or exchange-traded funds (ETFs) that track the performance of the overall market. It’s also important to have a long-term perspective and not get caught up in short-term market fluctuations. Finally, it’s a good idea to regularly review and rebalance your portfolio to ensure it aligns with your investment goals.

Savvy Trader AI

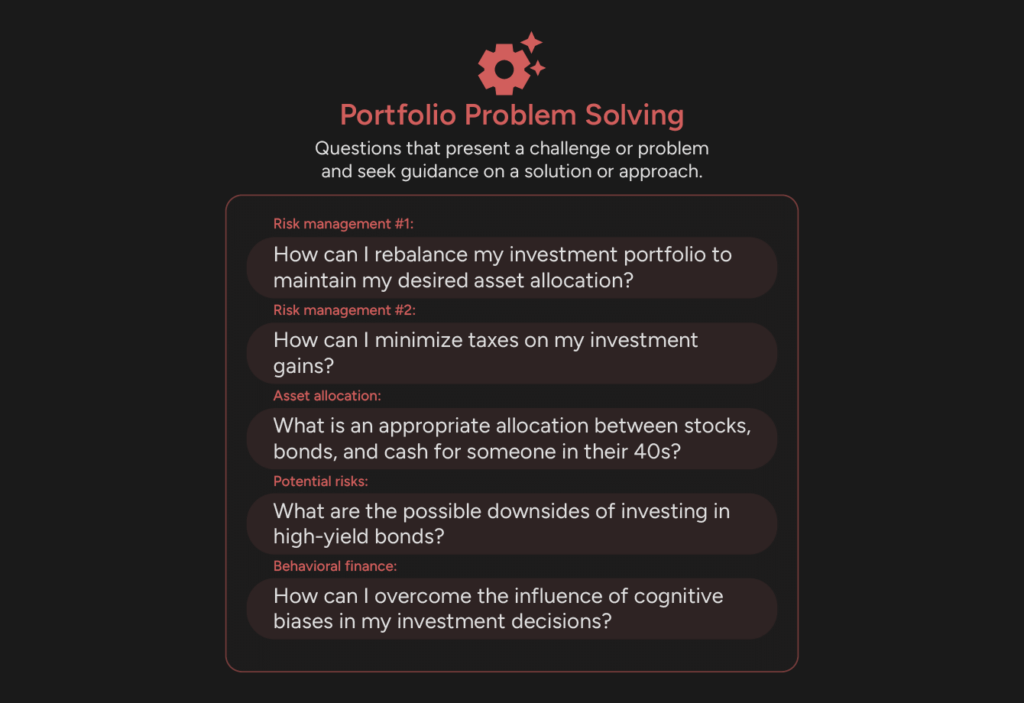

6. Portfolio Problem Solving

SavvyTrader.ai can assist with risk management, asset allocation, and overcoming cognitive biases if you’re facing challenges with your investment portfolio. You might ask:

How can I rebalance my investment portfolio to maintain my desired asset allocation?

One way to rebalance your investment portfolio is to sell some of the assets that have appreciated in value and use the proceeds to purchase more of the assets that have underperformed. This will help you maintain your desired asset allocation and ensure that you are not taking on too much risk. Another option is to invest new funds into the underperforming assets to bring them back up to your desired allocation. It’s important to regularly review and adjust your portfolio to ensure that it aligns with your investment goals and risk tolerance.

Savvy Trader AI

In conclusion, SavvyTrader.ai is a powerful tool that can help you easily navigate the world of investing. Whether a beginner or an experienced investor, this ChatGPT-powered assistant can provide valuable insights and guidance to help you make informed financial decisions.