Disclaimer: The information provided in this article is for educational and informational purposes only and should not be considered financial advice. The author is not a financial advisor and the content of this article is not intended to be a substitute for professional financial advice. Always seek the advice of a qualified financial professional before making any financial decisions.

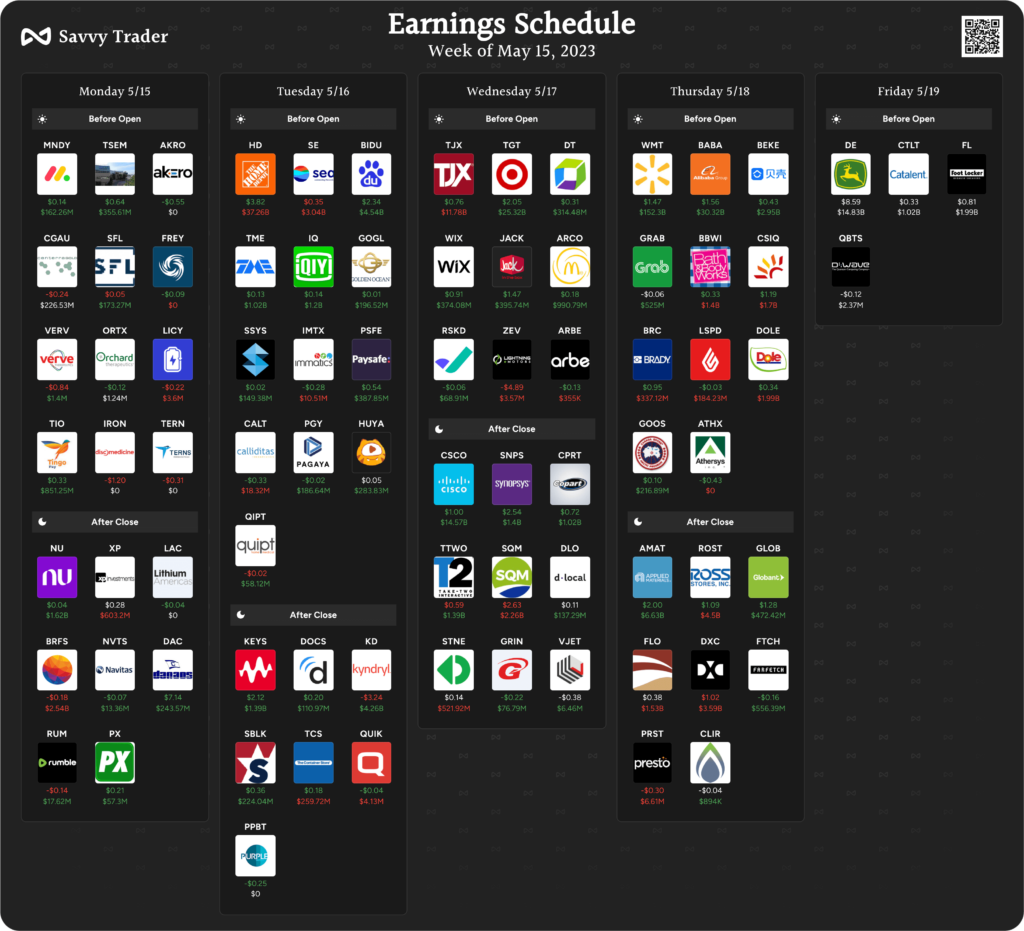

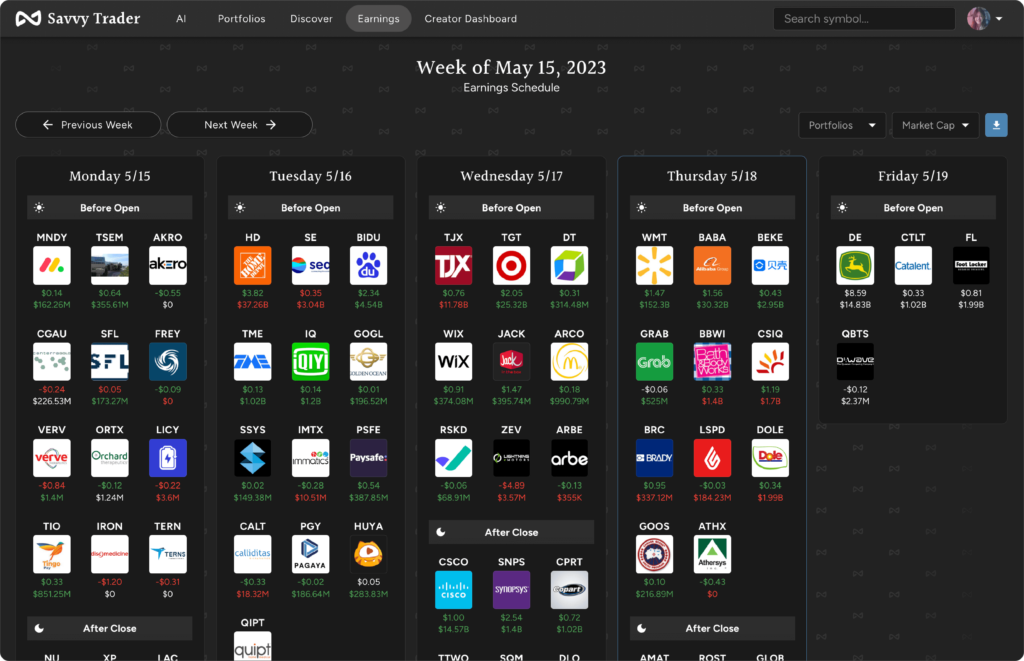

We’re thrilled to announce the launch of a Stock Earnings Calendar, an essential resource for investors looking to stay informed and make data-driven decisions. In this post, we’ll explore the significance of earnings reports, discuss why upcoming reports are crucial for investors, and delve into the analysis of these reports, focusing on EPS and revenue numbers. So, let’s dive in and discover all the benefits the Savvy Trader Earnings page has to offer.

What is an Earnings Report?

An earnings report is a financial document released by publicly traded companies on a quarterly basis. It provides investors with essential information about the company’s financial performance, including revenue, expenses, net income, earnings per share (EPS), and more. Earnings reports are a critical tool for investors as they help gauge a company’s overall health, growth prospects, and future performance.

Why are Upcoming Earnings Reports Important for Investors?

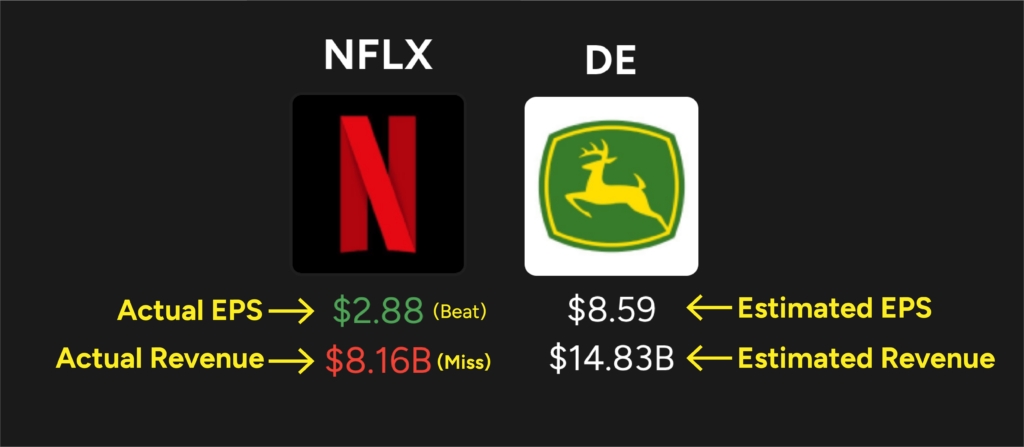

Upcoming earnings reports give investors the opportunity to analyze estimates for EPS and revenue, then see if the actual numbers reported beat or miss those estimates. Beating estimates typically causes a stock price to rise, while missing estimates often leads to a price drop. Anticipating upcoming earnings reports is vital for additional reasons:

- Price fluctuations: Stock prices tend to fluctuate in anticipation of earnings reports as investors adjust their positions based on expectations. Accurate forecasts can potentially result in substantial gains.

- Strategic decisions: Companies often announce significant changes in strategy, management, or future guidance during earnings calls, which can impact investors’ decisions.

- Benchmarking: Earnings reports allow investors to compare a company’s performance against industry peers and historical data, helping them make informed decisions.

How to Analyze an Earnings Report

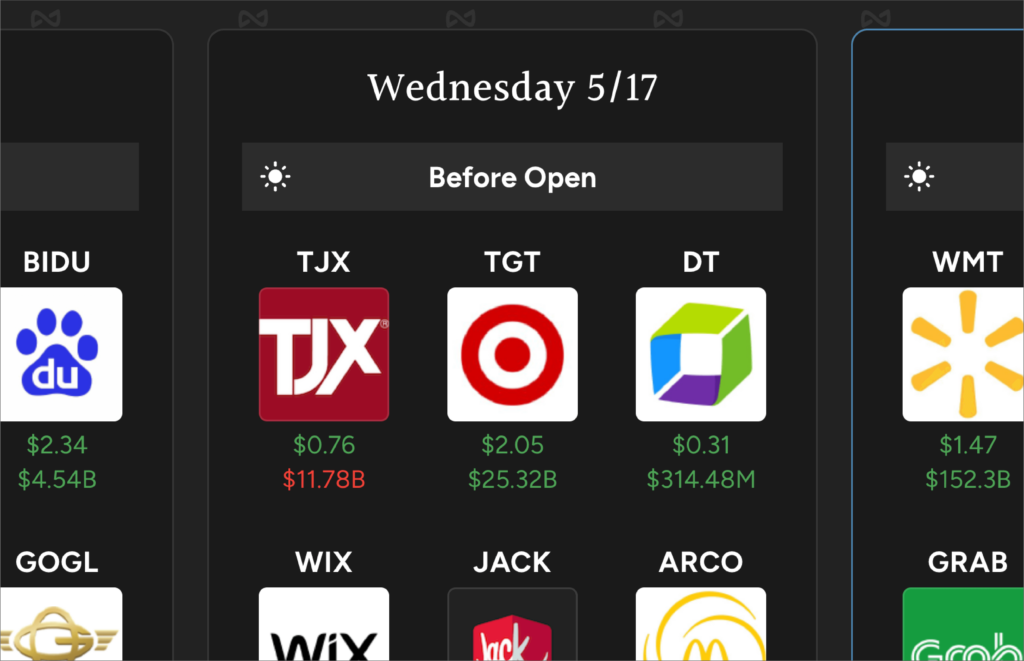

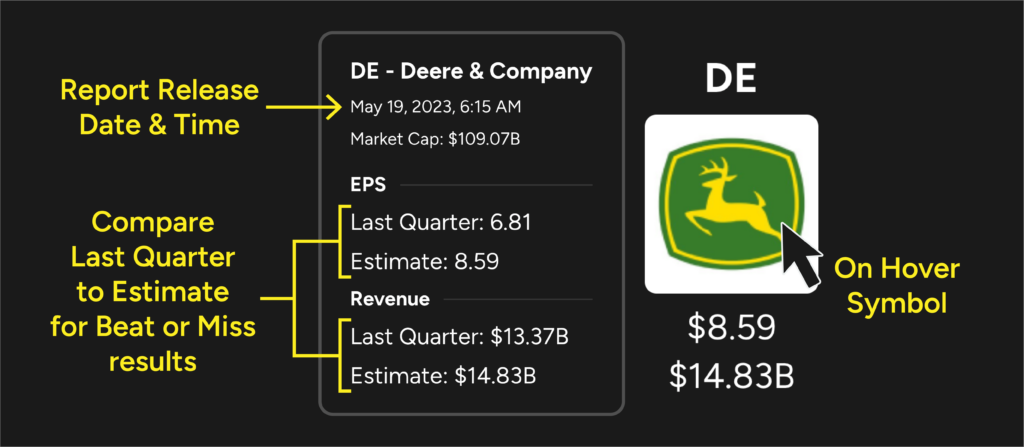

Savvy Trader’s new Earnings page provides all the details needed to analyze a company’s earnings report. Focus on the EPS and revenue numbers, which are displayed prominently for both estimates and actuals. Compare actual EPS and revenue to the estimates, as well as to numbers from the prior quarter and same quarter last year. Look at the percentages to easily see if the company beat or missed estimates. Strong revenue growth and increasing profit margins over time are also signs of a healthy company. When analyzing an earnings report, pay attention to the following key aspects:

- Revenue: Check if the company’s revenue meets or exceeds analysts’ expectations, as this can impact the stock price.

- Earnings per Share (EPS): Compare the company’s EPS to analysts’ estimates and previous quarters to gauge its profitability.

- Guidance: Companies often provide future guidance on revenue and earnings, which can influence investors’ decisions.

- Industry trends: Keep an eye on the performance and outlook of the company’s industry to determine its growth prospects.

The Importance of EPS and Revenue Numbers

EPS and revenue numbers are particularly important for investors as they provide a snapshot of the company’s financial health:

- EPS: A company’s earnings divided by its outstanding shares, EPS is a measure of profitability. Comparing actual EPS to estimates helps investors determine if a company is performing better or worse than expected.

- Revenue: The total income a company generates from its business activities. High revenue growth is often considered a sign of strong demand for a company’s products or services.

Savvy Trader’s Earnings page makes it easy to access EPS and revenue numbers, with color-coded indicators to quickly identify whether a company has beaten or missed estimates.

Experience the Savvy Trader Earnings Page

The Savvy Trader Earnings page is a game-changer for informed investors. With its intuitive, user-friendly layout, easy navigation, downloadable schedule, and wealth of EPS, revenue and estimated data, the Earnings page makes it simple to find opportunity, and stay ahead of the market. Check out the Savvy Trader Earnings page and start leveraging earnings reports for smarter investing.